Applicants with Very poor VantageScore get tend to more than likely possess the software rejected, if you’re those people that fall under the indegent classification would have to make-do having disadvantageous costs and maybe large off payments.

If the a candidate has a fair VantageScore rating , its finance get accepted but installment loans in Austin NV with bad credit not at the finest prices. Good scorers can also enjoy competitive credit pricing, when you find yourself Advanced level scorers are certain to get an educated costs while the very easier mortgage conditions.

How come credit history impression interest levels?

Credit scores are an indication of how good a person has addressed its loans costs or any other relevant finances over the years, which then systems the possibilities of the latest candidate using its a great fund promptly.

Lenders use these types of as the reason behind exactly how lowest or how highest the eye costs for each and every candidate could be.

Because of this applicants with reasonable borrowing from the bank exposure constantly take pleasure in lower rates, while people who have highest borrowing from the bank chance would have to developed having high interest rates if you don’t enjoys their software completely rejected.

Since it’s very very easy to get an unsecured loan today, it may be appealing to utilize unsecured loans into the only about something that requires a big sum of money. But not, remember that numerous loans you are going to head one to accumulate excess financial obligation, that’s the reason signature loans if at all possible is always to just be useful the second motives:

- Debt consolidation reduction

- Student loan refinancing

- Credit rating improve

- Emergencies

Debt consolidation

Whoever has multiple highest-interest bills usually takes out a consumer loan in order to combine all money into the one monthly payment. Unsecured loans will usually have lower interest rates as compared to current debt, and come up with paying down expenses faster.

Education loan refinancing

Personal loans could also be used for student loan refinancing purposes. Student education loans usually have large interest levels ranging from 6% and up, and ultizing a consumer loan to settle figuratively speaking will translate to lower rates of interest and faster obligations payments.

not, keep in mind that this can have specific issues. This is exactly anything from dropping brand new tax positives related to with a preexisting education loan to losing advantages such as for example deferment and forbearance.

Credit history update

With blended money is an excellent means to fix change your credit get, and you will taking out a personal loan may help inside diversifying debts particularly if the debt stems from a single class, such as for example playing cards.

When must i have fun with other loan choices?

Almost every other mortgage possibilities, eg playing cards, mortgage loans, home collateral loans and other secured personal loans are used for objectives that will be novel on character of one’s mortgage by itself.

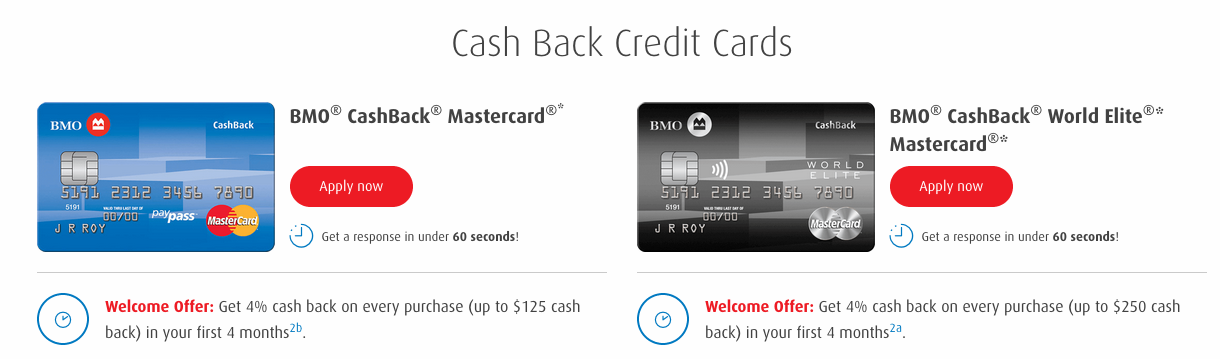

Playing cards may be the hottest kind of individual money because the they may be approved quickly & are used for virtually things, out-of every single day orders so you can mid-level sales such as for instance mobile phones to help you highest-level requests instance furniture. Extra items & one-week sophistication period give next incentives just in case you pay off the balances monthly. People which roll over an equilibrium from month to month shell out hefty attention charge. Those who skip payments could see their costs dive when you’re most other charge is actually put in their membership and you will/otherwise its personal line of credit try smaller.

NOTE: Once you learn you’ll be able to to spend your own borrowing from the bank card regarding entirely & was unlikely in order to roll-over an equilibrium its good particular small-term capital. For many who bring an equilibrium monthly & accumulate financial obligation which have attention charges next other styles of financial support get be a much better possibilities.

Auto loans normally charge fairly lowest rates since it is a little easy for loan providers so you’re able to reposess vehicles in the event your debtor doesn’t shell out its obligations.