Our very own basic-day homebuyer grant supporting qualified people as much as 2% of the off-percentage otherwise settlement costs to their very first home. 1 Professionals could possibly get be eligible for doing $eight,five-hundred when you look at the down-payment offers. 1

What do I want to pertain?

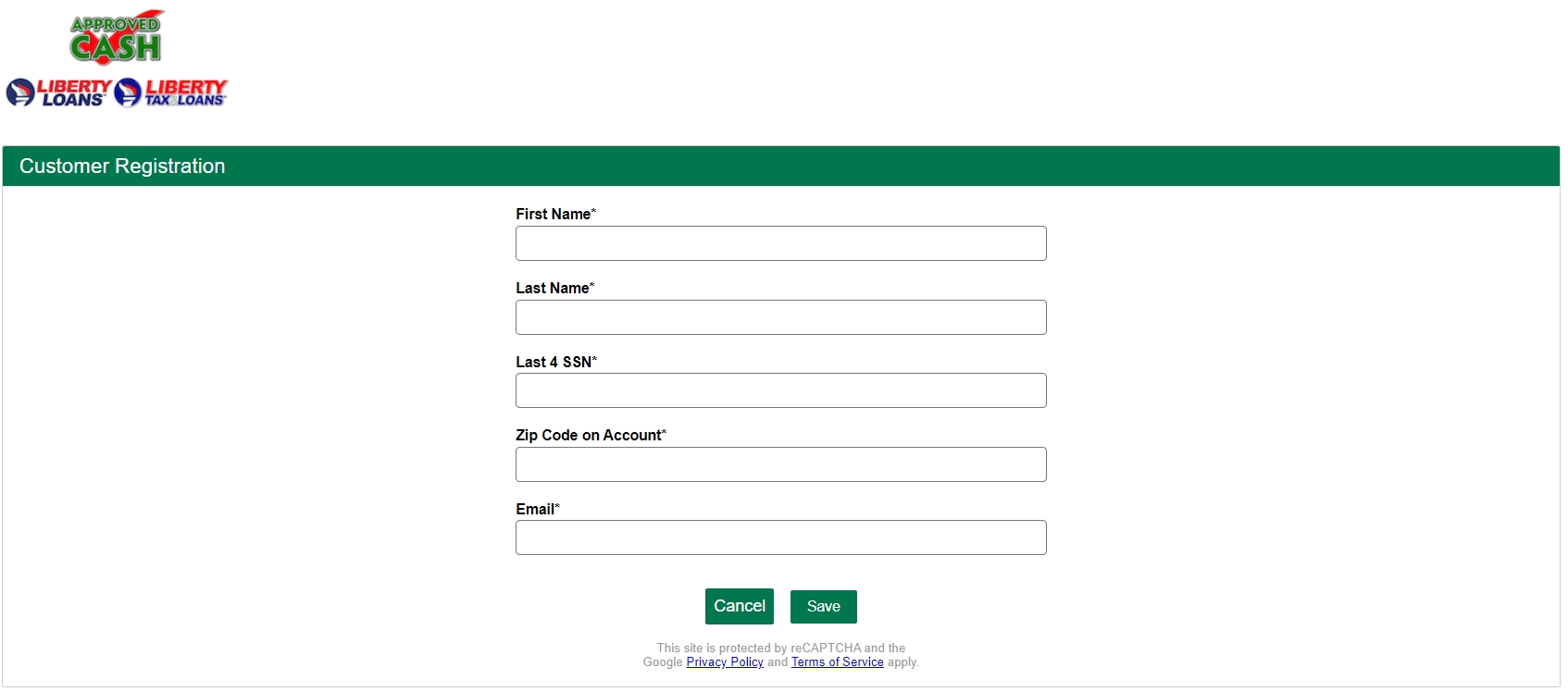

You could potentially phone call BECU within 800-233-2328, go to a beneficial BECU department otherwise implement on the internet. For many who incorporate on the internet, await the next concern:

To possess a house buy: Need to qualify with the BECU First-Go out House Visitors Grant System? Discover Yes when you have assessed the latest eligibility conditions at the and you will faith you could possibly get be considered.

Note: For people who supply it webpage on the smart phone your own wireless provider can charge you having appropriate studies charges. Excite check with your cordless provider about their cost package. Message and you can analysis prices get implement.

How come the method works?

Overall funds available for which Very first-Go out Family Consumer (FTHB) Grant program is restricted consequently they are reserved with respect to the order in which eligibility is determined. While making an initial dedication out of qualification to possess BECU FTHB Give finance, BECU tend to feedback brand new offer software when you are examining the loan software.

The amount of a grant usually do not surpass a minimal out of three limits: (A) 2% of price of the property; (B) 2% of your own appraised property value the home, or (C) $seven,500. In the event the real advance payment and you will/otherwise settlement costs is actually below the level of grant funds reserved, then finance disbursed from the closing was restricted to actual settlement costs and you may/or advance payment. Before any amount of funds are going to be kepted to have an offer, yet not, individuals should provide an acceptable totally executed pick deal distinguishing brand new property as ordered. In the event the a software is eligible just before acknowledgment from a reasonable, totally executed pick package, up coming loans would-be reserved towards grant after, in the event that available, immediately after receipt of such a binding agreement.

Can i pay the cash return?

No cost of give becomes necessary. Yet not, all the federal, condition, and you will regional taxes enforced to the enjoy of an offer are exclusively the duty of your candidate. BECU have a tendency to issue a keen Irs Mode 1099-MISC otherwise W-dos to a candidate in which a type 1099-MISC otherwise W-dos needs by the relevant law. Applicants is consult her accountant(s) or income tax advisor(s) to determine tax ramifications, or no.

Where need certainly to my personal house be found becoming entitled to money?

A minumum of one candidate must be a first-date household customer who does not currently very own one home-based actual property, and you may that is to find property in the usa off Washington, Oregon, or South carolina, or perhaps in Benewah, Bonner, Edge, Clearwater, Idaho, Kootenai, Latah, Lewis, Nez Perce, otherwise Shoshone State, Idaho.

Associated Posts

1 in buy so you can be eligible for the new grant loans, buyers must fulfill all the Very first-Go out Homebuyer Give System requirements along with financing eligibility and possessions certification, many of which may not be this amazing. BECU supplies the ability to alter otherwise changes grant standards or lending standards.

dos So you’re able to qualify for this new give loans, consumers need certainly to satisfy all of the Family$tart Program standards as well as loan eligibility and you can assets official certification as outlined by the brand new Federal Mortgage Lender from Des Moines. Give criteria and you may financing requirements subject to alter with no warning.

4 Home Perks is an application provided by Primary Alliance Real Home Qualities, LLC that’s maybe not affiliated with BECU. Specific constraints incorporate. Also offers at the mercy of transform without warning. Please get hold of your assigned Associate Recommend for more information from such buyer/seller pros. A residential property functions provided with cautiously selected local real estate professional.

5 Cash back examples trust brand new payment paid back to the new authoritative a property representative who’s symbolizing you once you get property. The latest example $2000 fast loan assumes on a total percentage off six% of the sales speed shared similarly between your number broker and you can the new selling representative (3% each), one of which try representing your. The fresh numbers more than can be used for illustrative objectives simply. The discount is different. Contact your representative endorse for lots more detailsmission rebates is actually paid shortly after your order has actually closed.

The government, county, and you may regional taxes enforced to your acceptance of a grant was entirely the burden of the candidate. BECU have a tendency to procedure an Internal revenue service Function 1099-MISC otherwise W-2 to help you a candidate in which an application 1099-MISC or W-2 needs because of the applicable rules. Individuals is to demand their accountant(s) or taxation mentor(s) to decide taxation effects, if any.