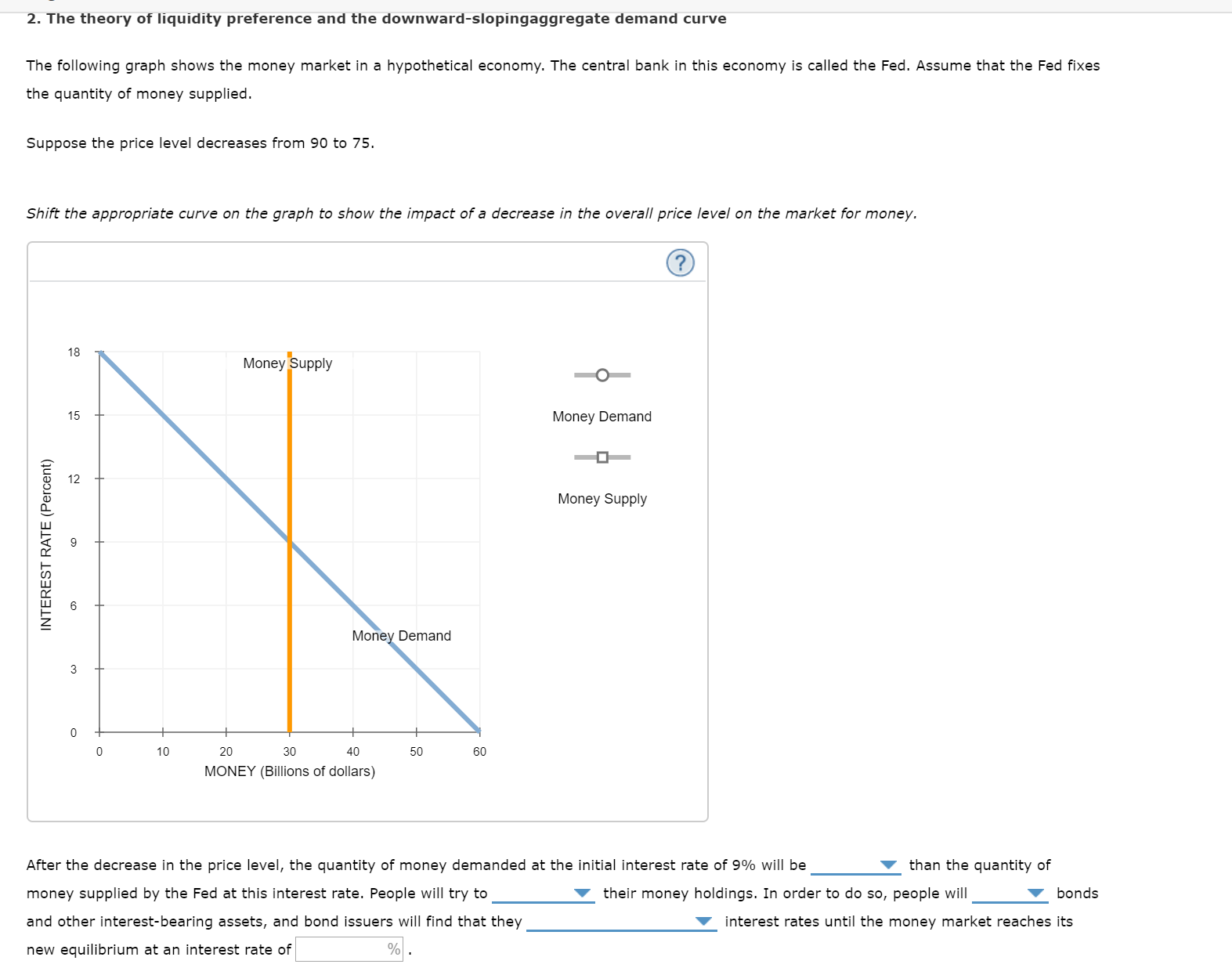

- Financing expertise: Among the first strategies of having good USDA financial is to find an effective USDA-approved financial that meets your unique need. When considering a loan provider, it’s also possible to ask how much cash sense he’s got with USDA finance as well as how most of the team arises from bringing USDA fund. You may also ask in the event that the loan officers have any unique degree towards the USDA fund.

- Interest rates: If you’re online research offer a general notion of what to predict, it is always far better make sure to provides an intensive comprehension of the present day field rates. The interest rate you can located will eventually count into several activities, including your credit rating, DTI and a lot more. Rates alter daily and you may move since business varies. A skilled USDA bank can help you dictate if most readily useful time to protected mortgage tends to be.

- Customer satisfaction: Customer service and satisfaction accounts are crucial details to adopt whenever shopping for a lender. You can get a far greater feeling of prior customers’ enjoy of the discovering on the internet product reviews and you can testimonials. Whenever reading critiques, you really need to pick preferred templates that may suggest how well the financial institution works, such as punctuality, efficiency otherwise friendliness.

- Loan process: Asking good USDA financing lender just how its procedure performs might help you understand the brand new USDA loan pre-approval techniques from inside the greater detail. Of many USDA-approved loan providers has actually a faithful team to include an advanced level of customer support to each visitors. Understanding more and more its financing techniques can help you understand in the event the the lender prioritizes an individual relationship otherwise performance inside the loan process.

CIS Mortgage brokers

CIS Mortgage brokers Essex Village loans is the full-solution home loan financial that can help you change your perfect house into your new home. With over 25 years of experience, i assist household arrive at their homeownership wants. We let possible people understand the certain USDA home loan procedures and supply tricks for USDA rural loan applications. We away from benefits requires pride in our capacity to offer industry-leading service getting users rather than compromising brief-urban area ideals and you may attraction.

For individuals who meet with the USDA money standards or other criteria, you need to take the starting point to receive your own mortgage, that’s taking pre-certified. Pre-certification are a more informal procedure where you bring standard suggestions to a mortgage lender that have information regarding your income, assets, costs and expenditures. A mortgage professional will make use of these facts to select the loan amount you really can afford in addition to possible acceptance qualification.

This new pre-certification techniques makes it possible to determine the cost assortment you can qualify having, letting you comprehend the budget you can test to possess a beneficial coming domestic. Within the pre-degree procedure, there isn’t any credit history studies. Getting pre-accredited as well as does not be sure you will have an interest rate. Pre-qualification are an effective publication for prospective property owners to appreciate their qualification better.

cuatro. See an excellent USDA-Approved Home

Certainly one of other requirements, brand new USDA operates to assist family members within the rural components fulfill their goals from the are people. You can travel to the fresh new USDA’s mortgage eligibility standards to get into a keen interactive map to see if your home is within the an area the newest USDA talks of since outlying. Knowing the concept of an outlying urban area can also help you determine if your house otherwise town suits brand new USDA’s requirements.

Identified as a rural Urban area

Having a property to meet the USDA’s definition of residing in an outlying city, it should be additional a city otherwise town, maybe not within the a city. Concurrently, the fresh USDA sets forth certain restrict populace thresholds, because the discussed of the census.